Stock trading, an intricate world of opportunities and risks, demands expertise, investment tips, strategy, and a disciplined approach to success. To navigate this realm effectively, seasoned experts have laid down a set of golden rules that serve as guiding principles for aspiring traders.

Here, we unveil these time-tested recommendations that form the cornerstone of successful stock intraday trading. So let’s get started.

1. Thorough Research is Key:

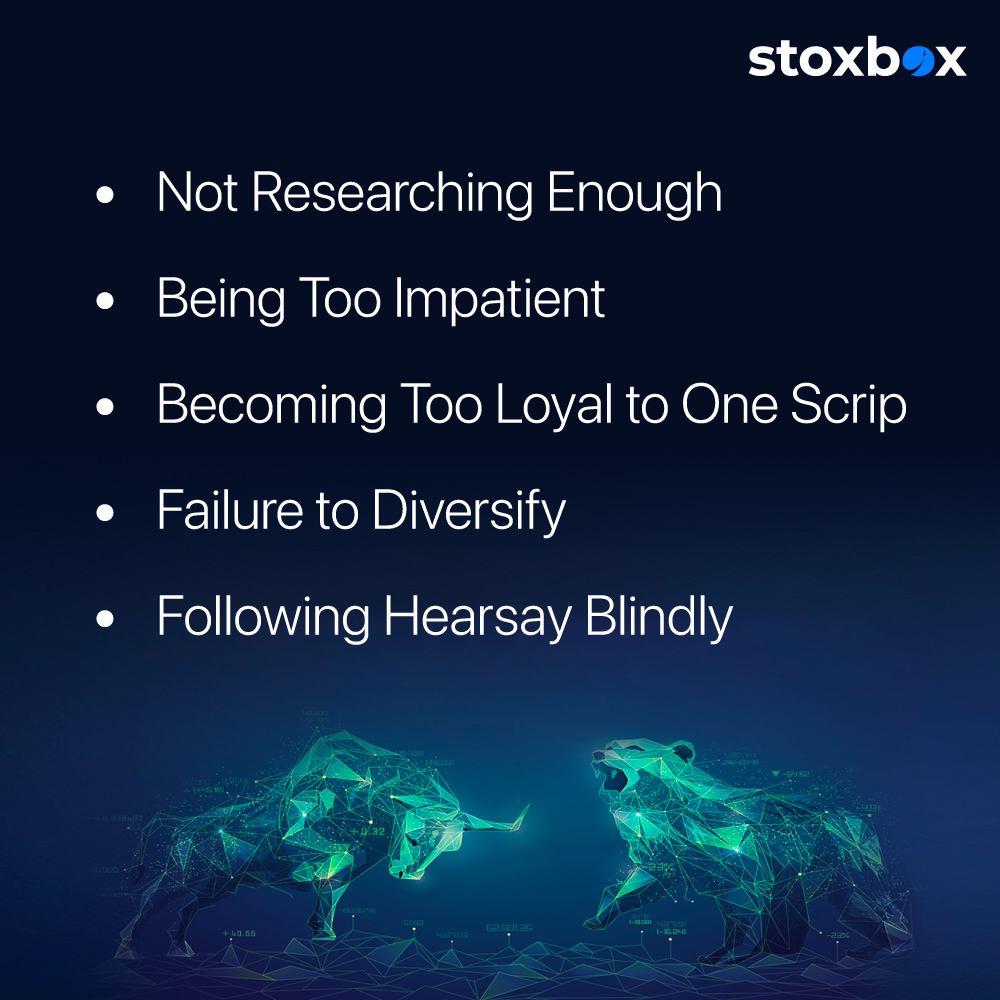

Successful traders prioritize in-depth research. Before investing, analyze market trends, bse live charts, company fundamentals, financial reports, and industry outlooks. Informed decisions based on comprehensive research enhance the probability of success.

2. Develop a Sound Trading Plan:

Craft a robust trading plan outlining your goals, risk tolerance, entry and exit strategies, and investment timeline with your demat account. A well-defined plan provides clarity and prevents impulsive decisions driven by market fluctuations.

3. Embrace Diversification:

Diversifying your portfolio across different sectors, industries, and asset classes minimizes risk exposure. It safeguards against potential losses in case of stock or forex market downturns or adverse movements in specific stocks.

4. Practice Risk Management:

Limiting risk exposure is vital. Successful traders set stop-loss orders to protect against significant losses and employ position-sizing and f&o strategies to manage risks effectively.

5. Control Emotions:

Emotions can manipulate your forex trading judgment and lead to irrational decisions. Successful traders maintain emotional discipline, stay objective, and avoid impulsive and rapid actions driven by fear or greed.

6. Follow a Consistent Strategy:

Stick to a consistent indian trading app & trading strategies that aligns with your goals and risk appetite. Whether it’s day trading, swing trading, or long-term investing, consistency is crucial for success.

7. Continuous Learning and Adaptation:

The stock market evolves, and successful traders adapt accordingly. Constantly educate yourself, learn intraday tips, stay updated on market trends, and be open to modifying strategies based on new information.

8. Patience and Discipline Pay Off:

Patience is a virtue in stock trading. Avoid chasing quick gains, and stay disciplined in executing your trading plan. Long-term success often results from patient adherence to strategy.

9. Practice Caution with Leverage:

While leverage can amplify gains, it also magnifies losses. Please exercise caution when using leverage and understand its intraday trading strategy, implications on risk exposure, and overall portfolio.

10. Monitor Market Trends and Sentiments:

Stay attuned to market sentiments, news, and trends. Awareness of market movements helps in making informed decisions and adjusting strategies accordingly.

11. Continuous Review and Adaptation:

Regularly evaluate your stoxcalls trading performance, analyze successes, and learn from mistakes. Adapt your strategies based on these reviews to improve trading outcomes.

12. Seek Guidance and Mentorship:

Learning from experienced traders or seeking mentorship can provide valuable insights and perspectives. Engage with trading communities, attend workshops, or seek guidance from seasoned professionals.

Adhering to these golden rules of successful stock trading offers a roadmap to navigate the complexities of the market. Expert guidance emphasizes the importance of research, discipline, risk management, and continuous learning.

By following these principles, aspiring traders can embark on their stoxcalls strategies, stock trading journey with a strategic and disciplined approach, increasing their chances of achieving success in the dynamic world of stock markets.