Opening a demat account to invest in the stock market can be an exciting way to multiply your wealth over time, but it requires careful consideration and analysis. With thousands of businesses (stocks) to choose from, selecting the right stocks for your portfolio can seem daunting. However, by focusing on key factors and conducting detailed research, investors can make accurate decisions that match their financial goals and risk tolerance.

In this article, we will learn about the key factors to evaluate when picking stocks on a share trading app for your portfolio.

- Company Fundamentals: Fundamental analysis is essential for evaluating a company’s financial health and performance. Open demat account and start examining the company’s financial statements, including its balance sheet and income statement. Look for indicators of profitability, such as consistent revenue growth, strong profit margins, and positive cash flow. Additionally, assess the company’s debt levels, liquidity, and asset quality to gauge its financial stability and solvency.

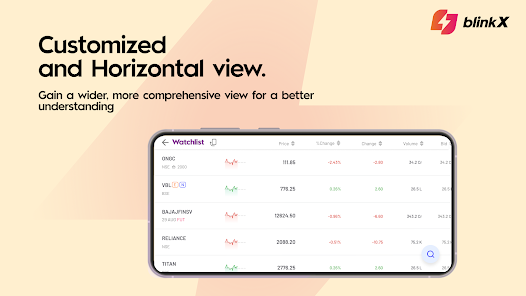

- Industry and Market Trends: Consider the industry in which the company operates and analyze broader market trends that may impact its performance. Evaluate the company’s competitive position within its industry, including market share, product differentiation, and barriers to entry. An online trading app can help you stay informed about industry dynamics, technological advancements, regulatory changes, and economic conditions that could affect the company’s growth prospects and profitability.

- Management Team: A company’s management team plays a crucial role in driving its success and executing its business strategy. Use a share market app to research the background of the stocks you are planning to invest in and track records of the company’s executives, including the CEO, CFO, and other key leaders. Assess their experience, leadership skills, and alignment with shareholders’ interests. Look for signs of effective corporate governance, transparency, and ethical leadership practices.

- Growth Potential: Evaluate the company’s growth potential and prospects for earnings expansion. Analyze historical growth rates, sales forecasts, and projections for revenue and earnings growth. Consider factors such as product innovation, market expansion, acquisitions, and strategic partnerships that could drive future growth. Look for companies that come with sustainable competitive advantages and a clear path to long-term profitability. An online investment app with the best features can help with this research.

- Valuation Metrics: Assess the valuation of the stock relative to its underlying fundamentals and peers in the industry. Consider valuation metrics, for example, the price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and price-to-sales (P/S) ratio. Compare these metrics to historical averages and industry benchmarks to determine whether the stock is undervalued, fairly valued, or overvalued. Keep in mind that while a low valuation may indicate a potential buying opportunity, it’s essential to consider other factors as well, such as growth prospects and market conditions.

- Risk Factors and Considerations: Assess the risks associated with investing in the stock, including company-specific risks, industry risks, and macroeconomic risks. Consider factors such as competitive threats, regulatory risks, geopolitical events, and market volatility that could impact the stock’s performance. Diversify your investment portfolio across multiple sectors and asset classes to mitigate risk and protect against unforeseen events.

In conclusion, picking stocks for your portfolio requires careful analysis and consideration of various factors. With diligence and discipline, investors can build a diversified portfolio of high-quality stocks that have the potential to deliver strong returns over time.