Today, there are numerous methods available for borrowing money. Banks have typically been the standard option for obtaining loans and financial assistance. However, online lending platforms are becoming more popular because they are easy to use and available to everyone.

We’ll explore the distinctions between online lending and traditional banks to highlight the advantages of obtaining an instant loan online.

Speed and Convenience:

One of the most significant differences between online lending and traditional banking is the speed and convenience of the process. With the instant loan app, borrowers can apply for a loan from the comfort of their own home or on the go using a computer or mobile device. The process is straightforward and can be completed in a matter of minutes, with funds deposited directly into the borrower’s bank account within hours or days. In contrast, traditional banking often involves lengthy application procedures, in-person meetings, and waiting periods for approval and disbursement of funds.

Accessibility and Inclusivity:

Online lending platforms are often more accessible and inclusive than traditional banks, particularly for individuals with limited access to brick-and-mortar banking services. People living in rural or remote areas may find it challenging to visit a physical bank branch, while those with busy schedules may struggle to find the time for in-person appointments. A loan app eliminates these barriers by providing 24/7 access to loan applications and customer support, making financial assistance available to a broader range of people.

Streamlined Application Process:

Online lending platforms typically offer a streamlined application process that requires minimal documentation and paperwork. Borrowers can fill out an online form, provide basic personal and financial information, and submit supporting documents electronically. In contrast, traditional banks may require extensive paperwork, proof of income, collateral, and credit checks, which can be time-consuming and cumbersome for borrowers.

Flexibility and Customization:

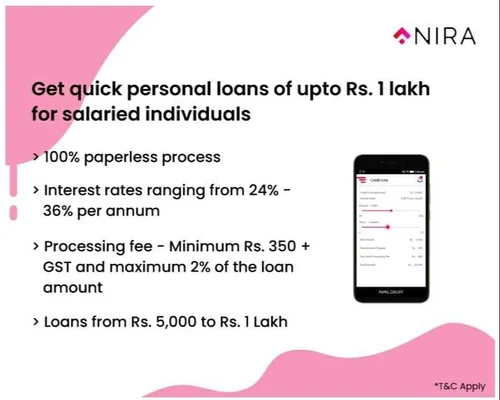

Online lending platforms often provide more flexibility and customization options for borrowers than traditional banks. Borrowers can choose from a variety of instant loan products with different terms, interest rates, and repayment options to suit their needs and preferences. Online lenders may be more ready to work with borrowers with imperfect credit histories or unique financial circumstances, whereas traditional banks may have stricter eligibility criteria.

Lower Fees and Interest Rates:

In many cases, online lending platforms offer lower fees and rates than traditional banks. Since online lenders operate with lower overhead costs and may have access to alternative sources of funding, they can pass on these savings to borrowers in the form of competitive loan terms. Additionally, online lenders may offer promotional deals, discounts, or rewards programs to attract new customers and encourage repeat business.

In conclusion, while both online lending and traditional banking have their advantages and disadvantages, instant loans offer distinct benefits in terms of speed, accessibility, and inclusivity. By providing a streamlined application process, flexible loan options, and competitive terms, online lending platforms empower borrowers to fix the financial assistance they need quickly and conveniently. As technology continues to evolve, online lending is likely to become a popular choice for individuals seeking loans and other financial services.