Trading and Investing are the two buzzwords taking over the market these days. You see finance gurus on reels advise which stocks to invest in, trading apps online claim the best rewards, and success stories in newspapers sell the idea of rags to riches, but as much as we are exposed to these stories, we can’t seem to wrap our heads around what mutual funds actually are.

1. What are Mutual Funds?

Mutual Funds (MF, in short) pool money from many individuals and invest it in a wide range of assets like stocks, government bonds, or other financial instruments. The person responsible for managing this pool is called a fund manager, a professional with financial expertise whose job is to make smart decisions about where the money should go to earn the best possible returns.

2. Who should choose mutual funds?

Mutual funds are a well-liked compromise for individuals who wish to invest without personally selecting individual stocks. Professionally managed, they offer potential tax advantages, automatic rebalancing, and diversification.

3. How do you track mutual funds?

Generally, people use mutual funds tracker to monitor the market’s ups and downs and the status of their investments.

4. What is trading?

Trading is the practice of purchasing and disposing of financial assets over brief periods of time, such as stocks, commodities, forex, or cryptocurrencies. Traders want to profit quickly by taking advantage of market changes. Trading moves quickly, takes a lot of time, and is heavily reliant on timing and technical analysis.

5. Who should trade?

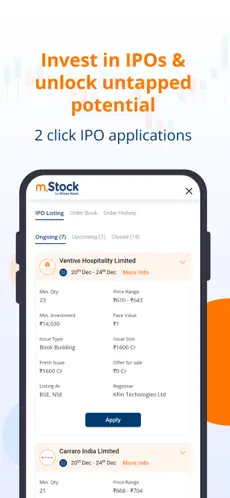

Anyone can trade, but those who like making decisions quickly, spotting trends, and interacting with the market directly will find trading appealing. With the right tools, particularly the top mobile trading apps available today, you can trade from anywhere.

6. What is investing?

Allocating funds with the goal of producing long-term returns is known as investing. Depending on the company’s or asset’s intrinsic value, investors usually purchase and hold assets like stocks, mutual funds, or exchange-traded funds (ETFs) for years or even decades.

7. Who should invest?

Investing is the best option for people who wish to increase their wealth gradually over time with little assistance. Thanks to platforms like investment apps, building a solid portfolio is now simpler than ever before.

Trading, investing, and mutual funds all serve different purposes and are for different kinds of investors. You can either choose one of them or all of them based on your risk appetite and your pocket capacity.

While there are many hotshot stocks and trending funds available in the market, don’t chase the clout. Invest safely and after ample research so you don’t lose any of your hard-earned money.

Understanding your objectives, using the appropriate tools, and maintaining consistency are the keys to success, regardless of whether you decide to be a patient investor or a fast-moving trader. Thanks to the increasing accessibility of trading and investing apps, anyone with a smartphone and a little curiosity can now dabble in the world of financial markets.